The Definitive Guide to Fredericksburg bankruptcy attorney

Most of the leftover debt are going to be forgiven. That has a Chapter 13 bankruptcy, the court docket will purchase you to Are living inside of a budget for up to five yrs, in which era most of your respective personal debt might be repayed. In any case, creditors will cease contacting and you can begin finding your economical existence back again so as.

Have creditors garnished your wages? Bankruptcy can avert or conclusion wage garnishment. Are you dealing with foreclosure? Bankruptcy can reduce or hold off foreclosure and repossession.

Earnings demands. Once you file a Chapter 13 bankruptcy, it's essential to establish it is possible to manage to pay your every month family obligations as well as regular program payment. The bankruptcy courtroom will never "ensure" or approve your proposed Chapter thirteen prepare if you do not have any profits or It can be far too small.

You should not deliver any sensitive or private data by means of this site. Any details sent by This website won't develop an attorney-customer romantic relationship and is probably not treated as privileged or private.

Here's a snapshot of Whatever you'll do in Chapter 13 bankruptcy from start out to finish. Right after reviewing the 9 steps, you'll be ready to deal with the more challenging aspects of Chapter thirteen—eligibility and the particulars of your Chapter thirteen system.

Personal debt.org hopes to assist those in personal debt recognize their finances and equip themselves with the equipment to deal with personal debt. Our information is available for totally free, having said that the solutions that appear on This great site are provided by providers who may well pay back us a marketing and advertising payment once you click on or enroll.

With Chapter 7, lenders who may have now filed to foreclose on your own home are only temporarily stalled, and pop over to this site also other debts such as mortgage loan liens is often collected once the scenario is concluded. Cosigners on the debts are still obligated to pay for.

We offer absolutely free consultations to discuss your exceptional predicament and supply expert tips, regardless of whether by telephone, in-Place of work, or practically. With in excess of 50 several years of combined bankruptcy legislation experience, Nathan Fisher and Michael Sandler possess the abilities and determination to be certain your case is managed effectively the first time. Opt for us for dependable, professional, and compassionate authorized help.

Invoice and Kathy needed to repay the court docket charges and again taxes they owed. They had to be present on their mortgage loan and motor vehicle payments. The decide discharged 50 % other of their charge card debt.

When the bankruptcy courtroom will not verify your strategy, the trustee will refund your payments. Nonetheless, Will not be expecting to obtain vehicle payments again—your automobile lender will credit rating your account.

In exchange for having to pay many of your debts, there are numerous crucial Gains the Bankruptcy Code supplies for you, which can make this type of bankruptcy a helpful selection. A Chapter thirteen bankruptcy may in some cases allow you to minimize Whatever you purchase your automobile (including your curiosity prices), lessen several of your tax liabilities (together with tax penalties), and remove a 2nd home finance loan from the home.

Stage two- Examine Possibilities – he has a good point Your attorney will Consider what type of bankruptcy is acceptable. There are 2 sections of the federal bankruptcy code, Chapter seven and Chapter 13, that are employed for submitting own bankruptcy with regards to the particular person circumstances. A Chapter 7 bankruptcy, often referred to as straight bankruptcy, entails the sale of non-safeguarded belongings to pay back as much financial debt as feasible and lets a debtor to possess most debts dismissed including bank card credit card debt and healthcare expenses. It is on directory the market for people who would not have regular profits to pay their obligations.

Action three – Get Credit rating Counseling – All people who are planning to file a Chapter 7 or Chapter thirteen particular bankruptcy are essential to complete a pre-bankruptcy credit counseling course in six months prior to filing for bankruptcy. The company may perhaps put together a financial debt repayment plan.

The trouble is most filers are eager see this to get out of their terrible fiscal problem that they will choose any deal that is offered to them. The attorney’s Business office will then indication you up for a payment program by way of a 3rd-occasion firm, normally by way of automated payments designed over a regular foundation.

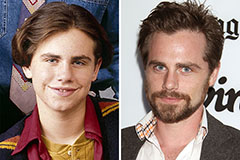

Rider Strong Then & Now!

Rider Strong Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now!